Related reading: If you’re building tax-efficient income alongside guaranteed retirement income, see our guide to Hybrid Pensions & Annuities and how they fit into broader Retirement Income Planning.

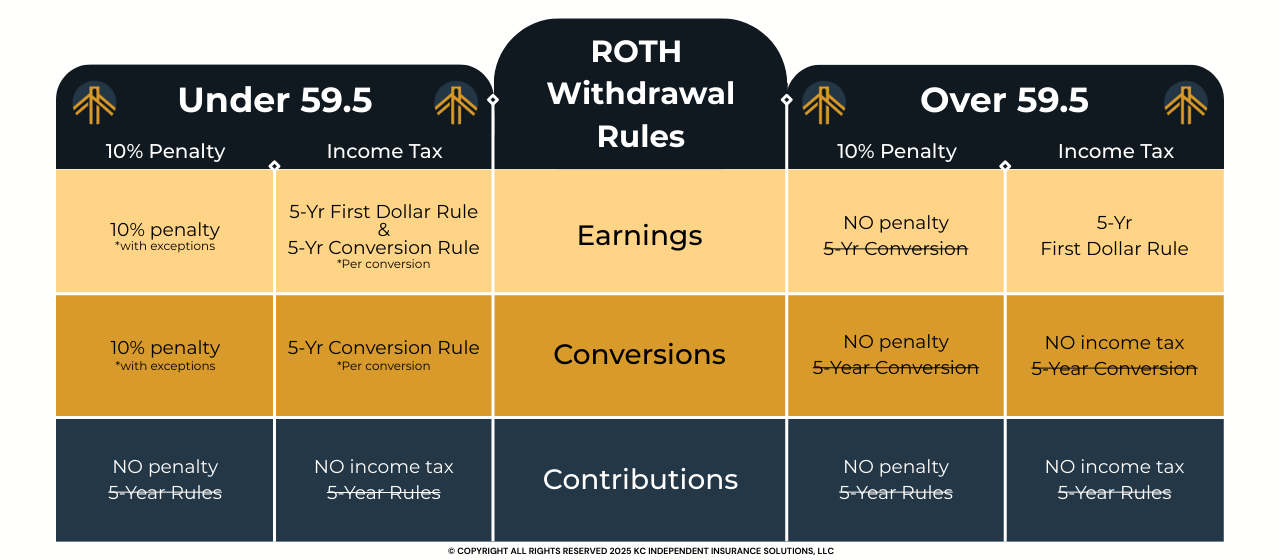

Roth IRAs are powerful tools for creating tax‑free retirement income and reducing future Required Minimum Distributions (RMDs). But the withdrawal rules—especially after Roth conversions—are often misunderstood. The confusion usually comes from three things:

- Different rules for contributions, conversions, and earnings

- Two separate 5‑year rules

- Different outcomes depending on whether you are under or over age 59½

Below is a clear, step‑by‑step explanation of how Roth IRA withdrawals actually work.

Important Tax Disclosure (Please Read First)

We are not Certified Public Accountants (CPAs) or tax attorneys, and this article is for educational purposes only. The Roth IRA withdrawal rules discussed here are based on IRS Publication 590-B (Distributions from Individual Retirement Arrangements), which outlines the federal rules governing Roth IRAs as of the 2024 tax year.

Tax laws, IRS guidance, and interpretations can change from year to year, and Roth conversions and withdrawals can create permanent and irreversible tax consequences. For that reason, you should always review your personal situation with a licensed CPA or qualified tax professional before completing any Roth conversion or taking a Roth IRA distribution.

The Three Layers of a Roth IRA

Think of a Roth IRA as having three layers, each with its own rules.

Layer 1: Roth Contributions

Roth contributions are the dollars you personally contribute from earned income.

- Contributions are made with after‑tax dollars

- Subject to annual IRS contribution limits

- No income tax when withdrawn

- No 10% penalty

- No 5‑year rule applies to contributions

This is always the easiest and most flexible layer to access.

Layer 2: Roth Conversions

A Roth conversion occurs when you move money from a Traditional IRA or pre‑tax retirement account into a Roth IRA.

- You pay income tax at the time of conversion

- There is no dollar limit on conversions

- Withdrawals of converted principal are not taxed again

However, conversions follow their own 5‑year penalty rule, which is where most mistakes happen.

Layer 3: Roth Earnings

Earnings are the growth inside your Roth IRA—interest, dividends, and gains.

- Earnings have never been taxed

- This layer has the strictest rules

- Taxes and penalties depend on age and both 5‑year rules

The Two 5‑Year Rules Explained

The First‑Dollar 5‑Year Rule (Account Ownership)

This rule determines when earnings can be withdrawn income-tax‑free.

- The clock starts January 1 of the year of your first Roth contribution or conversion

- Once satisfied, this rule is permanently satisfied

This rule applies to earnings only.

The Conversion 5‑Year Rule (Penalty Rule)

This rule applies only to Roth conversions and only if you are under age 59.5. Once you are over 59.5, this rule no is no longer relevant for you.

- Each Roth conversion has its own 5‑year clock

- Withdrawing converted funds early may trigger a 10% early withdrawal penalty

- Income taxes do not apply because tax was paid at conversion

Think of each conversion as having its own stopwatch running at the same time.

If You’re Under Age 59.5

Contributions (Layer 1)

- No penalty

- No income tax

- No 5‑year rules

Contributions can always be withdrawn first and freely. Again, you’ve already paid taxes on these funds before you even put them in here, so you’re not going to be hit again on the same dollars when you try and pull them out.

If You Are Age 59.5 or Older

Contributions (Layers 1)

Once you reach age 59.5, the rules become much simpler.

- No 10% early withdrawal penalty

- No income tax

Like for those under 59.5, you’ve already paid taxes on these funds before putting them in, so you won’t be paying them again when you take it out.

Conversions (Layer 2)

- 10% early withdrawal penalty applies unless each conversion has met its own 5‑year clock

- No income tax (already paid)

To avoid the 10% penalty:

- Each conversion must be at least 5 years old, or

- You must qualify for an IRS exception (disability, first‑time home purchase, qualified disasters, etc.) See IRS publication 590B for a full list of exceptions.

Conversions (Layer 2)

- No 10% early withdrawal penalty, regardless of when the conversion occurred

- No income tax

Even if you have not met the first‑dollar 5‑year rule, the age 59.5 exception eliminates penalties on contributions and converted principal.

Earnings (Layer 3)

This is the strictest layer.

If you are under 59.5 and withdraw earnings before satisfying both the First-Dollar 5-year rule and the Conversion 5-year rule (if applicable), then:

- Earnings are taxable as income

- A 10% early withdrawal penalty may apply (again, see IRS publication 590B and consult with your CPA for exceptions)

This is where most Roth mistakes occur.

Earnings (Layer 3)

Earnings depend on the first‑dollar 5‑year rule.

If you are over 59.5 AND your Roth IRA has been open at least 5 years, meaning you satisfy the first-dollar 5-year rule:

- No 10% early withdrawal penalty

- No income tax on withdrawals

If you are over 59.5 but just opened your first Roth IRA, meaning you haven’t satisfied the first-dollar 5-year rule:

- No 10% early withdrawal penalty (age exception applies)

- Earnings may still be taxed as income

IRS Publication 590-B makes clear that the 10% early withdrawal penalty does not apply once the age 59.5 exception is met, but the First Dollar 5-year rule must still be satisfied for withdrawals from earnings to not be taxed as income.

A common misconception is that people over 59.5 must wait five years for each conversion. According to IRS Publication 590‑B, this is not true. The conversion 5‑year rule does not apply once the age exception (being 59.5 or older) is met.

Important Warning: Roth Conversions Cannot Be Undone

Prior to the Tax Cuts and Jobs Act of 2017, Roth conversions could be reversed through a process called recharacterization. That option no longer exists.

Once you convert:

- The taxes are permanent

- The strategy cannot be reversed

Careful planning is essential.

How Roth IRAs Work With Annuities

For a deeper dive into how annuities create lifetime income, see:

- What Is an Annuity and How Does It Work?

- Are Hybrid Pensions a Scam?

- Choosing the Best Annuity: A Strategic Guide for Retirement Income Planning

When a Roth IRA owns an annuity, distributions follow LIFO (Last‑In, First‑Out) rule, meaning that earnings are considered withdrawn first.

If you’re following our chart, that means that for those age 59.5 or older, as long as the first‑dollar 5‑year rule is met, Roth annuity income can flow out tax‑free and penalty‑free.

Because many Roth strategies are designed for long‑term income, most individuals are not accessing these funds within the first five years anyway, especially when using staged or laddered income strategies.

Final Thoughts

If Roth strategies are part of a broader plan to reduce future Required Minimum Distributions, you may also find our breakdown of the Accelerated RMD 5-Bucket Strategy helpful, along with our perspective on Why Passive Income Is So Powerful.

Roth IRAs can be one of the most powerful tools in retirement—but only when the rules are clearly understood and properly coordinated with the rest of your income plan.

Final Reminder:

This article is based on IRS Publication 590-B (2024) and is provided for educational purposes only. We are not CPAs, and tax rules are subject to change. Always consult your CPA or qualified tax professional before executing Roth conversions or withdrawals.

Contact Us Get in Touch

Have a question or feedback?

Fill out the form below, and we’ll respond promptly!

By providing your name and contact information, you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.