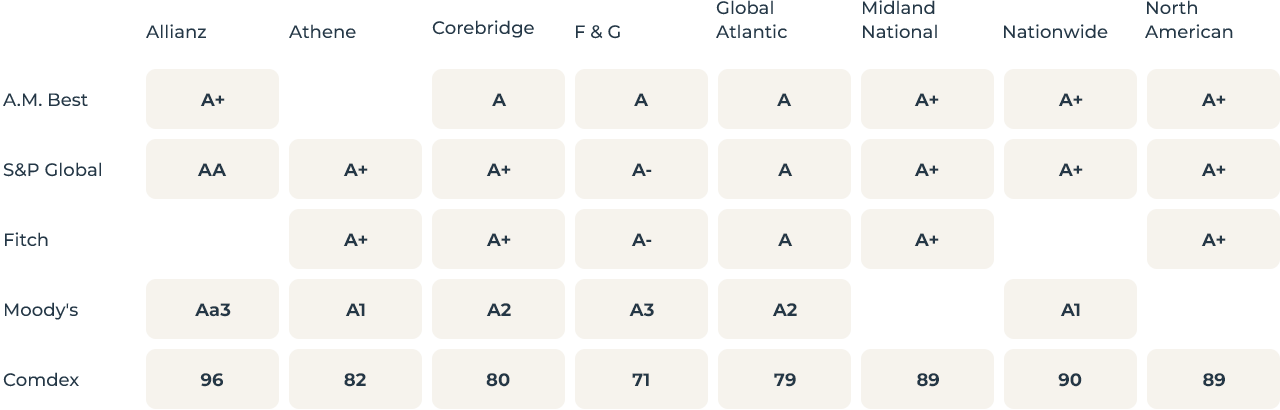

Insurance Carrier Rating Information

Why are Insurance Carrier Ratings important to you?

- They help you compare insurers based on financial stability.

- Higher-rated companies are more likely to pay claims without delay or dispute.

- Ratings may affect policy pricing, guarantees, and consumer confidence.

How to Interpret Ratings

Insurance carrier ratings are independent evaluations of an insurance company’s financial strength, claims-paying ability, and overall stability. These ratings help consumers, agents, and financial advisors assess whether an insurer is likely to honor its policy obligations — especially important for long-term policies like life insurance or annuities.

A Comdex score is a composite insurance company rating that summarizes and ranks the financial strength of life and health insurance companies on a scale from 1 to 100 — with 100 being the highest possible rating. The Comdex score is not a rating itself, but rather a ranking that combines the ratings of major independent agencies.

Insurance Carrier Rating Table

Allianz is a globally recognized insurance and financial services company headquartered in Munich, Germany, with a strong presence in over 70 countries. Founded in 1890, Allianz is one of the world’s largest and most financially stable insurers, offering a wide range of products including life, health, property and casualty insurance, as well as investment and retirement solutions. In the U.S., Allianz Life Insurance Company of North America is well-known for its annuities and life insurance products, often used for retirement planning and income protection. The company consistently earns high financial strength ratings from agencies like A.M. Best, Moody’s, and S&P, and typically holds a high Comdex score, reflecting its stability and strong claims-paying ability.

Athene is a U.S.-based retirement services and annuities insurer founded in 2009 and now a wholly owned subsidiary of Apollo Global Management following a 2022 merger. Headquartered in West Des Moines, Iowa, Athene specializes in retail fixed and fixed-index annuities, institutional funding agreements, pension risk transfers, and flow reinsurance, managing hundreds of billions in assets — about $381 billion in GAAP assets as of March 2025.

Corebridge Financial — formerly the life‑and‑retirement division of AIG and known as American General — is a major U.S. provider of retirement solutions, life insurance, wealth management, and institutional financial products, headquartered in Houston, Texas. Launched as an independent publicly traded company in September 2022, with significant equity backing from both AIG and investors like Blackstone and Nippon Life, Corebridge manages over $400 billion in assets under management and administration and offers a full spectrum of annuities (fixed, fixed‑index, variable), term and permanent life insurance, group retirement plans, and structured institutional solutions like pension risk transfers and stable value wraps.

F&G Annuities & Life, Inc. (often marketed simply as F&G) is a publicly traded U.S. life insurance and annuities provider based in Des Moines, Iowa, tracing its origins to 1959 under the name Fidelity & Guaranty Life. Today, the company specializes in a range of retirement-focused products—fixed-rate and indexed annuities, deferred and immediate annuities, plus individual life insurance — and serves over a million policyholders through a broad network of around 82,000 licensed agents. Recently ranked #1 in customer satisfaction among U.S. annuity providers in J.D. Power’s 2023 study — with a score of 843 out of 1,000—F&G demonstrates strong performance in product offerings, communication, pricing, and service.

Global Atlantic Financial Group is a leading U.S. provider of retirement security, life insurance, annuities, and reinsurance solutions. Established in 2004 within Goldman Sachs’ reinsurance unit, it became independent in 2013 and was fully acquired by KKR in 2024, strengthening its integration with KKR’s investment capabilities. Headquartered with operations across the U.S., Bermuda, and Japan, it offers a diverse portfolio including fixed, indexed, variable, and income annuities, as well as preneed life insurance and institutional reinsurance products. With a track record of managing large reinsurance blocks (e.g., $19.2 billion from MetLife) and approximately $183 billion in assets under management, Global Atlantic blends insurance expertise with private equity-level investment solutions to support long-term policyholder security.

Midland National Life Insurance Company — part of Sammons Financial Group and based in West Des Moines, Iowa (with life operations in Sioux Falls, South Dakota) — has been a privately held insurer since its founding in 1906 (originally as Dakota Mutual Life), adopting its current name in 1925. It offers a broad range of retirement-focused products, including fixed and indexed annuities and life insurance, with over 1 million policies and more than $71 billion in assets as of 2022. Its ESOP-owned, privately held structure encourages long-term planning without short-term investor pressures. With a century-plus track record and consistent performance, Midland National is regarded as a financially robust option for those seeking life insurance and annuity products.

Nationwide Mutual Insurance Company — often simply known as Nationwide — is a Fortune 100, Columbus, Ohio–based mutual insurance and financial services organization founded in 1926. As a mutual, it is owned by its policyholders and emphasizes long-term stability and member-focused decision-making. Nationwide offers a comprehensive range of products, including auto, home, farm, pet, life insurance, as well as annuities, mutual funds, retirement plans, and specialty business lines — earning top rankings in pet, farm, corporate-life, and retirement-plan insurances. With over $298 billion in assets and $32.5 billion in revenue reported in 2023, it employs around 25,000 people and provides services nationwide.

North American Company for Life and Health Insurance is a privately held insurer based in Chicago, Illinois, and a core member of Sammons Financial Group. Founded in 1886, it has built a legacy of financial stability through conservative investment strategies and employee or private ownership, which shield it from short-term market pressures. It serves over 615,000 life and annuity policies nationwide, with assets exceeding $27 billion, and disbursed more than $547 million in death benefits during 2024. Its product lineup includes term, universal, and indexed universal life insurance, alongside fixed-index annuities, all distributed through more than 121,000 agents. With a century-plus track record and private structure, North American emphasizes long-term customer focus, disciplined financial stewardship, and dependable policyholder service.

Contact Us Get in Touch

Have a question or feedback?

Fill out the form below, and we’ll respond promptly!

By providing your name and contact information, you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.