Independent Licensed Insurance Agents who work hard to earn your business

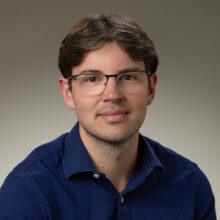

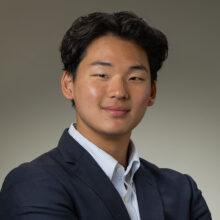

At KCIIS, you’ll work with a warm, family-oriented team that treats your retirement planning like it’s their own. Led by Kai and Ann Chung, along with dedicated agents Jennifer Chin, Jake Jiang, Jaidan Chung, Aaron Sandberg and Jennifer Kester, we bring years of expertise, personal care, and real-life experience to every conversation. We know retirement decisions—especially around retirement income, annuities, Medicare, & Long-term Care—can be overwhelming, so we take the time to explain your options clearly, answer every question, and guide you without pressure. Our mission is simple: to make sure you feel confident, informed, and supported at every step. When you work with us, you’re not just getting advisors—you’re gaining trusted partners who genuinely care about your future.

We understand that retirement decisions—especially those involving income, annuities, Medicare, and long-term care—can feel overwhelming. That’s why we take the time to explain your options clearly, answer every question, and guide you without pressure.

Our mission is simple: to help you feel confident, informed, and supported every step of the way. When you work with us, you’re not just gaining advisors—you’re gaining trusted partners who genuinely care about your future. Through our proven process, we want you to feel ALL SET in retirement!

Our sole purpose is to help you retire happy and confident through our guaranteed retirement income and healthcare planning process. Known as the ALL SET Process (Simple + Educational + Transparent), it provides our clients with family-focused guidance, expert solutions, and lasting confidence.

Years of experience

Established in 2005, Kai and Ann Chung have been helping clients with their retirement plans for over two decades. Combined with their team of licensed insurance agents, KCIIS has over 50 years of experience.

Areas of expertise

The team at KCIIS is skilled in building proper retirement plans that focus on protecting your wealth, covering healthcare costs, and incorporating life insurance. As licensed insurance agents, our team can help you determine which products are best for you, including:

- Hybrid Pensions

- Annuities

- Pensions

- Medigap (Medicare Supplement)

- Medicare Advantage Part C (MA)

- Medicare Part D (Part D)

- Life Insurance

- Long-term Care Insurance

- Dental Insurance

Process and solutions

Planning for retirement can feel overwhelming—but our All SET process makes it straightforward and stress-free. We focus on being Simple, Educational, and Transparent so you always feel confident in your decisions.

- Simple – We take complex retirement strategies and turn them into clear, easy-to-understand solutions tailored to your needs.

- Educational – We go beyond the basics, sharing our knowledge and experience with patience, empathy, and a genuine desire to help.

- Transparent – We believe you deserve the full picture from start to finish, building trust and lasting relationships through honesty and open communication.

With our All SET Process you’ll have a retirement plan that’s not only smart, but one you truly understand.

Gracie

Retirement Puppy

Raymond Chin

Office Manager

Anaia Chung

Social Media Manager, EditorAnthony Gutierrez

EditorAndrew Briggs

Administrative AssistantMelissa Morgan

Administrative Assistant

Ethan Joo

Administrator“Working with Kai and his team has been great. I appreciate his integrity and skill to teach me my Medicare options and also the pension hybrid concept. I would highly recommend him and his team.”

Contact Us Get in Touch

Have a question or feedback?

Fill out the form below, and we’ll respond promptly!

By providing your name and contact information, you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.

![Meet the[br] [span]KCIIS Team[/span]](https://www.retiringoptions.com/wp-content/uploads/2025/09/Team-Banner-Edited.jpg)