When it comes to Medicare, you’re not on your own.

We understand that you might feel tempted to handle everything on your own. After all, you may assume that going directly through Medicare.gov or calling 1-800-MEDICARE is the simplest way to shop for a plan without feeling pressured by sales agents. But in our experience advising clients through Medicare transitions, this DIY approach can carry hidden risks, many of which are difficult or impossible to fix after enrollment. Let’s break down what you need to know.

Why Going It Alone Can Backfire

We often hear clients say, “I can just do this myself online.” And while you can, it doesn’t mean you should. Here’s why:

- Limited Insight – Government websites and customer service reps can only show you the same general plan info that everyone else sees. They aren’t licensed, and they’ve never worked directly with the plans.

- Outdated Information – We’ve seen cases where a doctor appears to be “in-network” on a plan’s website, only for clients to discover later that the information was incorrect.

- No Do-Overs – Unlike retail purchases, Medicare plans aren’t returnable. Once enrolled, you’re typically locked in for a whole year—even if the plan doesn’t work out.

When people DIY home repairs and make a mistake, they can call in a pro. But with Medicare, one misstep could mean being stuck in the wrong plan, potentially losing your doctor, and having limited access to care, all with no recourse until the next enrollment window.

The Truth About Medicare Agents

Not all agents are created equal, and unfortunately, not all are looking out for your best interest. Let us explain the three main types you may come across:

- Captive Agents – These agents can only offer products from one company. They’re often the most sales-driven, since their only goal is to place you into that company’s plan.

- Career Agents – These agents may have access to multiple companies, but will typically push the one they’re contracted with first.

- Independent Broker Agents – This is what we are. We work with a range of companies (in our case, over 50 plans across all 50 states). We can compare options side by side and help you weigh the pros and cons of each. Still, even independent brokers can only recommend the plans they are certified to sell, so you want someone with broad representation and a client-first mindset.

What the Wrong Agent Can Cost You

One of the most overlooked aspects of Medicare enrollment is the agent of record. Once you enroll through an agent, you’re tied to them—even if you become unhappy with their service. Unlike other industries, you cannot simply switch agents unless you switch to an entirely new plan. We’ve had clients ask us to take over their current plan, but Medicare doesn’t allow that. So it’s critical to get this right the first time. We always tell clients: the agent you choose is just as important as the plan itself.

Before You Switch Plans, Consider This

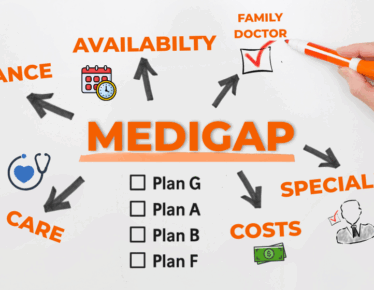

If you’re currently on a Medicare Supplement (Medigap) plan and considering switching to a Medicare Advantage plan to save on premiums or gain extra perks (like dental or vision), understand the risks:

- You may not be able to switch back without passing health underwriting.

- You’d need a special qualifying event, such as moving out of your plan’s service area, to re-qualify for Medigap without penalty.

Too often, we see people switch based on flashy benefits, only to regret it when they lose access to their preferred doctors or encounter strict rules for care approval.

Our Role Is to Guide, Not Sell

As fiduciaries and advisors, our job is not to sell you a product—it’s to help you understand what fits your unique health and financial situation. We are transparent about what each plan offers and what trade-offs you’re making. If your current coverage is working well, we’ll tell you to keep it. And if changes are worth exploring, we’ll walk you through them carefully.

Final Thought: Be Proactive, Not Reactive

Choosing the right Medicare plan is essential. Choosing the right person to help you with that plan is even more critical. If you’d like us to take a second look at your Medicare strategy—or if you’re starting the process and want to avoid costly missteps—let’s schedule a time to talk. We’re here to be a resource, not a pitch.

Contact Us Get in Touch

Have a question or feedback?

Fill out the form below, and we’ll respond promptly!

By providing your name and contact information, you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.