What is a Hybrid Pension?

When planning for retirement, finding a balance between income security and financial flexibility can be tricky. That’s where hybrid pensions come in — a modern solution blending annuity products with income guarantees to give retirees the best of both worlds. Let’s explore how hybrid pensions work, their key components, and why they’re gaining traction among those looking for reliable retirement income.

Understanding

Hybrid Pensions

A hybrid pension is essentially an annuity paired with a lifetime income rider. These financial products provide a steady income stream in retirement while allowing some level of control over the underlying assets. There are two main types of annuities used in hybrid pensions:

Fixed Indexed Annuities (FIAs)

A fixed index annuity is a type of retirement product designed to give you growth potential without exposing your money to full stock market risk. Think of it as a contract with an insurance company—your money is protected from market losses. However, it can still grow based on the performance of a market index (for example, the S&P 500).

Variable Annuities

A variable annuity is a retirement product that can give you both tax-deferred growth and the potential for lifetime income. Still, unlike a fixed index annuity, your money is invested in market-based subaccounts—similar to mutual funds. That means your account value can go up if the markets perform well, but it can also go down if they perform poorly.

Income Riders: Contractual vs. Hypothetical

Contractual Lifetime Income Riders

These come with a small fee (typically around 1%) but offer a guaranteed annual income increase — referred to as a “roll-up.” This guaranteed increase makes income predictable. A familiar example is Social Security, which grows by 8% per year if you delay claiming it.

Hypothetical Lifetime Income Riders

These riders may come with no fees, but their income payouts fluctuate based on market performance. This unpredictability can be risky for retirees relying on consistent income.

Annuity + Lifetime

Income Rider =

Hybrid Pension Plan

Flexibility and Control

What makes hybrid pensions truly unique is their flexibility. If the owner passes away or changes their mind, the remaining asset value can be passed on to beneficiaries. This is a major improvement over traditional pensions or annuities that may lock in the principal.

For those who live long, the income continues for life — helping manage the risk of outliving your savings.

Are 10–20% Payouts

Really Possible?

Yes, under certain contractual income riders, payout rates of 10–20% are possible. These rates depend on the rider’s terms, deferral period, and age at payout start. While that may sound high, it’s often the result of accumulated growth plus guarantees built into the rider.

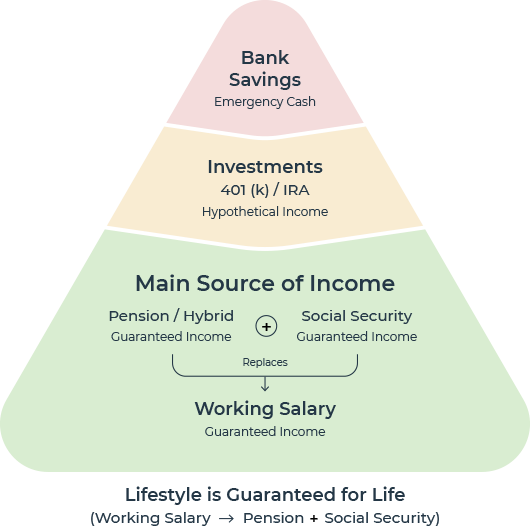

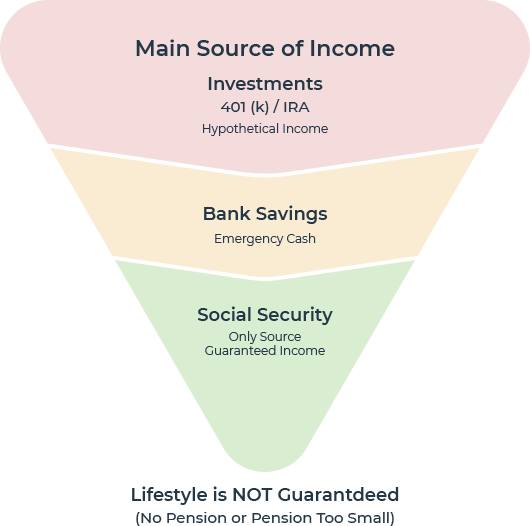

Hybrid pensions vs investments

Many people ask: “Should I invest in the stock market or buy an annuity for retirement income?” Hybrid pensions give you both growth potential and guaranteed lifetime income. Unlike stocks, bonds, or mutual funds — which rise and fall with the market — a hybrid pension guarantees a paycheck you cannot outlive. For many retirees, this creates a balanced plan: investments for long-term growth and legacy, and a hybrid pension for secure retirement income that covers essential living expenses.

How do annuities work?

Annuities are insurance contracts that convert savings into guaranteed retirement income. When you buy an annuity, you’re essentially creating your own personal pension. The insurance company guarantees payments, often for life, no matter what happens to the market. Hybrid pensions use annuities with income riders to provide steady income, while also protecting your principal and allowing some growth. For people searching “how to get guaranteed retirement income,” this is the exact solution.

How do I know if a carrier is good or not?

When comparing annuity companies, look for carriers with A-rated financial strength, strong claims-paying ability, and a history of fair renewal rates. We only recommend insurance companies with proven track records that prioritize policyholder outcomes. For those searching “best annuity companies this year” or “most trusted retirement income providers,” the answer is in picking firms with longevity, high ratings, and consumer-friendly policies.

Our clients choose us because we don’t just sell products — we create retirement income strategies. We answer the exact questions people ask online, like “What’s better, an annuity or the stock market?” or “How much guaranteed income can I get at age 65?” Through our All SET process (Simple, Educational, Transparent) we walk you through the math, highlight pros and cons, and show how a hybrid pension fits alongside Social Security, Medicare, and investments. That’s why so many people searching “best retirement income advisor near me” end up working with us.

What are the common mistakes retirees should avoid?

The biggest retirement planning mistakes include:

- Buying one large annuity instead of laddering for higher payouts and inflation protection

- Choosing the wrong rider (hypothetical vs contractual) and ending up with much less income

- Taking income too early, which permanently reduces payouts

- Forgetting to plan for inflation, health costs, or leaving a legacy

If you’ve ever searched “What mistakes to avoid with annuities” or “How to get more income from retirement savings,” avoiding these errors can mean hundreds of thousands more in lifetime income.

Are annuities/hybrid pension plans a scam?

This is one of the most searched questions: “Are annuities a scam?” The answer is no. Hybrid pensions and annuities are state-regulated contracts backed by insurance companies. The “scam” label usually comes from bad sales practices or agents who push one-size-fits-all products. When designed properly, annuities are one of the safest tools for guaranteed retirement income — much like Social Security or a workplace pension.

If you’re asking “Do I need an annuity?” “How much guaranteed income can I get at 65?” or “What’s the best retirement income plan for me?” — the next step is a personalized consultation. We’ll review your retirement accounts, Social Security benefits, and lifestyle needs, then compare options side by side. You’ll see exactly how much guaranteed lifetime income you can get, and how a hybrid pension may protect your savings while still leaving a legacy.

???? Schedule your free retirement income session today and get All SET for retirement.

Contact Us Get in Touch

Have a question or feedback?

Fill out the form below, and we’ll respond promptly!

By providing your name and contact information, you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.

![[span]Hybrid Pension[/span] and Annuities](https://www.retiringoptions.com/wp-content/uploads/2025/09/23016_TopBanner-HybridPA.jpg)