Why You Need Life Insurance

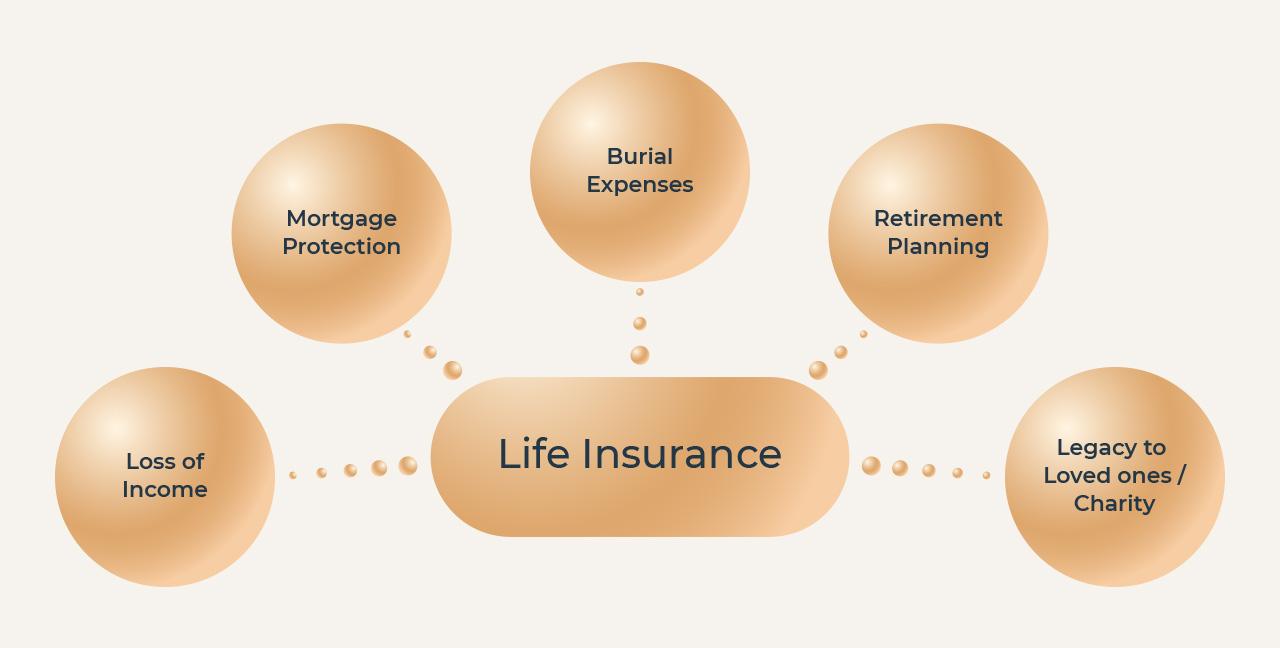

The emotional pain of losing a loved one is difficult enough. Why allow the stress of financial loss as well?

Term, Whole, or Universal Life?

Choosing the correct type of life insurance can be a daunting decision, but understanding your options is the first step toward securing peace of mind for you and your loved ones. Whether you’re new to life insurance or looking to review your current plan, we’ll guide you through each option to find the best fit for your needs.

Choosing the right life insurance depends on your needs. Here’s a quick breakdown:

Term Life Insurance

Term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years). If the insured dies during the term, the policy pays out a death benefit to beneficiaries. Once the term ends, coverage stops unless renewed, often at a higher cost. This option is typically the most affordable and is best suited for temporary needs, such as covering a mortgage or providing income replacement while children are dependent.

Key Components:

- Fixed Term – Coverage spanning a set number of years.

- Lower Premiums – Generally more affordable compared to permanent policies.

- No Cash Value – Pure insurance protection with no savings or investment feature.

Whole Life Insurance

Whole life insurance is permanent coverage that lasts for the insured’s lifetime as long as premiums are paid. It includes both a guaranteed death benefit and a cash value component that grows at a fixed rate over time. Premiums are usually higher but remain level for life. It can serve as both protection and a financial tool, offering the ability to borrow against the policy’s cash value.

Key Components:

- Lifetime Coverage – Guaranteed protection as long as premiums are maintained.

- Cash Value Growth – Builds savings at a guaranteed rate.

- Fixed Premiums – Payments remain consistent throughout the policyholder’s life.

Universal Life Insurance

Universal life insurance is a flexible form of permanent coverage. It combines a death benefit with a cash value component that grows based on interest rates or market performance (depending on the type of universal policy). These policies have adjustable premiums and death benefits within certain limits, making them adaptable as financial needs change.

Key Components:

- Flexible Premiums – Policyholders can increase or decrease premium payments.

- Adjustable Death Benefit – Policyholders can modify their coverage amount.

- Cash Value Linked to Interest/Markets – Growth depends on credited interest or market index performance.

Which is Best for You?

It’s not a one-size-fits-all decision. It’s like asking, “Is renting or owning better?” The answer depends on your situation. Do you need coverage for a set time or for life? Or maybe a mix of both?

How Do You Know What’s Best for You?

Answer these key questions to determine which life insurance option is right for your situation:

- Do you have a short-term need for coverage (e.g., mortgage protection or paying off debts)?

- Would you prefer lifelong protection with a savings component?

- Are you considering life insurance as part of your retirement planning?

- What’s your family’s financial situation, lifestyle, income, and debt ratio?

Get Your Personalized Plan

Schedule an in-depth consultation where we’ll analyze your family’s situation, goals, and financial circumstances. We can also discuss how to use life insurance as part of your retirement income planning, or perhaps you want some type of combination? Only after understanding your unique needs can we provide you with the most accurate suggestions and quotes for your life insurance.

Contact Us Get in Touch

Have a question or feedback?

Fill out the form below, and we’ll respond promptly!

By providing your name and contact information, you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.