What You Need to Know About Medicare’s Open Enrollment Periods

One of our priorities is helping you make confident, informed decisions—especially when it comes to Medicare. If your mailbox or email inbox is overflowing with Medicare plan advertisements right now, you’re not alone. Every fall, these marketing campaigns flood in, often creating more confusion than clarity. Let’s simplify this process together.

Two Critical Enrollment Windows to Know

There are two main Medicare enrollment periods that we want to focus on:

Annual Enrollment Period (AEP) – October 15 to December 7

During this time, you can:

- Switch from Original Medicare to a Medicare Advantage plan

- Switch from a Medicare Advantage plan back to Original Medicare

- Change from one Medicare Advantage plan to another

- Change your standalone Part D drug plan

Medicare Advantage Open Enrollment Period (MA OEP) – January 1 to March 31

This period is only for people already enrolled in a Medicare Advantage plan. You can:

- Switch to another Medicare Advantage plan

- Drop your Medicare Advantage plan and return to Original Medicare (but you must also enroll in a standalone Part D drug plan)

These windows don’t apply if you’re turning 65 or still working past 65. In that case, we’ll focus on your Initial Enrollment Period (IEP), a Special Enrollment Period (SEP), or General Enrollment Period (GEP) instead.

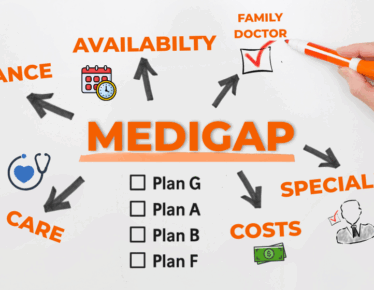

Medigap (Supplement) Plans Work Differently

If you currently have—or are considering—a Medigap (also called Medicare Supplement) plan, here’s something important: Medigap plans do not follow annual open enrollment rules. Instead, they only offer one guaranteed enrollment period—when you first enroll in Part B (typically at age 65 or retirement). After that, switching often requires you to pass health underwriting or qualify for a special event (like moving out of your plan’s service area).

So if you’re thinking about switching from a Medicare Advantage plan back to a Medigap plan, let’s talk early to ensure you can qualify—and avoid getting stuck.

Don’t Ignore the Annual Notice of Change (ANOC) Packet

Each September, you’ll receive something called an ANOC—Annual Notice of Change—from your current Medicare Advantage or drug plan provider. Many people mistake this for junk mail and toss it out. Please don’t.

This packet tells you how your plan is changing for the following year, including:

- Monthly premiums

- Deductibles and copays

- Changes to drug coverage

- Doctors or hospitals entering or leaving the network

- Extra perks (like dental, vision, or gym memberships)

If you didn’t receive this or accidentally threw it out, call your plan and request another copy. Then let’s review it together.

Thinking of Switching Plans? Let’s Strategize First

If you’re happy with your plan and its changes, you don’t need to do anything. But if something in your ANOC doesn’t sit well with you—or your doctor is leaving the network, or costs are going up—then yes, it may be time to consider switching. Just know that:

- The marketing materials you’re seeing highlight only the best parts of a plan.

- Your doctor’s participation in a plan is rarely emphasized, but critical.

- Once you switch, you’re locked into this plan for a year, and reversing it is often difficult.

If you’re considering moving from a Medicare Advantage plan to a Medigap plan, timing is key. We’ll need to get your Medigap application approved first before making any changes. Never cancel a plan based on a quote. And do not enroll in a standalone Part D plan unless you genuinely intend to leave your Medicare Advantage plan—it will automatically cancel it in most cases.

Should You Shop on Your Own? Maybe Not

You might be the DIY type, and we respect that. But when it comes to Medicare, going it alone can be risky:

- Medicare.gov is a good tool for comparing Advantage plans, but it doesn’t help with Medigap.

- Information online isn’t always accurate. A plan might list your doctor today, but they may not accept it.

- Unlike a retail return, Medicare decisions are locked in for a whole year—and sometimes for good.

That’s why we recommend working with a licensed, independent agent—someone who can help you compare options with no pressure and no added cost. (By the way, there’s no savings if you enroll yourself vs. using an agent.)

The Three Types of Insurance Agents – Know Who You’re Talking To

Here’s who you might deal with:

- Captive Agents: They can only sell one company’s plan and can’t discuss others.

- Career Agents: They sell one preferred company’s plans first, and others second.

- Independent Brokers: They offer a range of companies, but still only those with which they’re currently contracted.

Our firm works with over 50 carriers nationwide, and our priority is making sure any changes are in your best interest, not just what earns someone a commission.

Bottom Line: Make Sure You Have the Proper Coverage

If you’re on a Medicare Supplement plan and happy with it, stay. If you’re considering switching, let’s review your options with caution. If you’ve never looked into Medicare before, we’ll guide you step by step.

Together, we’ll:

- Review your ANOC packet (or request a copy if needed)

- Identify if changes affect your needs or providers

- Determine whether switching is necessary

- Compare plans without the sales pressure

- Handle the application timing properly to avoid costly mistakes

If you have questions or want to schedule a Medicare review session, reach out. We’re here to make this as stress-free and straightforward as possible, so you can focus on enjoying retirement with confidence and clarity.

The Three Types of Agents – Know Who You’re Talking To

Here’s who you might deal with:

- Captive Agents: They can only sell one company’s plan and can’t discuss others.

- Career Agents: They sell one preferred company’s plans first, and others second.

- Independent Brokers: They offer a range of companies, but still only those with which they’re currently contracted.

Our firm works with over 50 carriers nationwide, and our priority is making sure any changes are in your best interest, not just what earns someone a commission.

Bottom Line: Make Sure You Have the Proper Coverage

If you’re on a Medicare Supplement plan and happy with it, stay. If you’re considering switching, let’s review your options with caution. If you’ve never looked into Medicare before, we’ll guide you step by step.

Together, we’ll:

- Review your ANOC packet (or request a copy if needed)

- Identify if changes affect your needs or providers

- Determine whether switching is necessary

- Compare plans without the sales pressure

- Handle the application timing properly to avoid costly mistakes

If you have questions or want to schedule a Medicare review session, reach out. We’re here to make this as stress-free and straightforward as possible, so you can focus on enjoying retirement with confidence and clarity.

Contact Us Get in Touch

Have a question or feedback?

Fill out the form below, and we’ll respond promptly!

By providing your name and contact information, you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.