What to Expect for Medicare Open Enrollment 2025

As we approach Medicare’s Open Enrollment for 2025, we want to ensure you’re fully informed about what’s changing and how those changes may impact your healthcare and overall financial planning. This brief overview outlines what you need to know, what actions to consider, and how we can help guide you through the process.

Do’s & Don’ts

If you’re enrolled in a Medicare Advantage or Part D drug plan, you should have received your Annual Notice of Change (ANOC). Please review it carefully. If you’re satisfied with your current plan and the changes, there’s nothing more you need to do.

If you have a Medigap (Medicare Supplement) plan, there is no ANOC. These plans do not change annually in the same way, so unless you’re considering switching, no action is required.

However, if you’re not satisfied with your coverage — particularly after reviewing the upcoming changes — we strongly recommend watching our two new Medicare education videos before making any changes. We’ve included links at the bottom of this summary.

Why Part D Premiums Are Increasing

Many clients have reached out with questions about rising Part D premiums. The main reason is the removal of the Part D donut hole, which once required beneficiaries to pay more out of pocket for prescription drugs after reaching a coverage threshold.

While this change may sound positive, it has led insurance companies to raise premiums in anticipation of higher claim payouts. Increasing Medicare Part D premiums is a typical pattern we’ve seen before in health insurance markets. When deductibles are eliminated or reduced, premiums often increase significantly.

Fewer Plan Options and Higher Costs

For 2025, there will be fewer drug plan choices in many areas. Where there were once 30 to 50 Part D plans to choose from, most states will now offer only around 15. Some areas have just one or two options under $10 per month.

Part D plans for 2025 generally fall into three pricing tiers:

- A limited number under $10 per month

- A midrange group between $15 and $50 per month

- A higher-priced tier, around $80 to $90 per month

With less competition and rising costs, comparing plans will be more critical than ever.

How to Shop and Compare Part D Plans

If you require fewer or no medications or only use low-cost generics, plans like Cigna may be suitable. We’re awaiting final details on these plans and will notify you once enrollment is available through our portal.

If you require more complex or expensive medications, we will send you access to our Part D comparison tool to help you find the most cost-effective coverage.

Please note that WellCare will no longer pay agent commissions in 2025. If you choose or stay with a WellCare plan, we will not be able to assist you with that enrollment, but you may still select it if it remains your best option.

Should You Switch Medicare Plans?

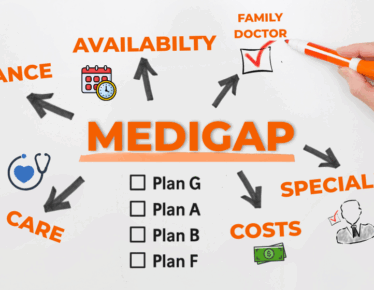

Many people ask about switching between Medicare Advantage and Medigap (Medicare Supplement). The advertisements for $0 premium Advantage plans with perks like dental, vision, or gym memberships can be appealing, but these are not available with Medigap.

Here’s a quick comparison:

- Medigap (Plan F, Plan G, etc.) offers broader provider access and more predictable costs, but at a higher premium and without built-in extras.

- Medicare Advantage offers lower premiums and added benefits, but may involve network limitations and higher out-of-pocket costs in some instances.

We strongly recommend watching our comparison video before switching—they outline the pros, cons, and long-term considerations that can affect both your healthcare and finances.

Want to Switch to a Medigap Plan?

If you’re thinking about transitioning to a Medigap plan, there are several things to evaluate:

- Higher costs – Expect to pay at least $2,400 annually, in addition to your Part B premium.

- Rate increases – Annual increases can range from 5 to 20 percent, depending on your plan and carrier.

- Separate drug coverage needed – You’ll need to purchase standalone plans for Part D, dental, vision, and fitness if desired.

- Medical underwriting – Applicants who do not meet guaranteed issue criteria will need to pass health questions to enroll in a Medigap plan.

If you’d like to see those health questions in advance, let us know. We can send you the underwriting criteria for different carriers so you can determine your eligibility.

Final Thoughts

With fewer options, rising premiums, and more plan changes than usual, this year’s Medicare Open Enrollment deserves close attention. We’re here to help you navigate these updates and make decisions that support both your health and your financial well-being. Let’s schedule time to review your current plan and ensure you’re positioned wisely for 2025.

Contact Us Get in Touch

Have a question or feedback?

Fill out the form below, and we’ll respond promptly!

By providing your name and contact information, you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.